A significant shift is underway in how seriously the investment community is taking their climate-related risks and responsibilities, and one of the biggest drivers is the increase in consumer demand for responsible and ethical investment. Consumers are increasingly aware of the role investors – such as banks and pension funds - can play in taking real action on climate change and are demanding more transparency about how their money is being invested.

These insights come from a recent report by the Responsible Investment Association Australasia (RIAA) – From Values to Riches 2022: Charting consumer demand for responsible investing in Australia. The report explores consumer awareness, practices, and attitudes towards ethical and responsible investments in Australia. The fifth annual report finds that two-thirds of Australians know what responsible investing is, up from 50% just two years ago. In addition, four out of five consumers surveyed (83%) expect their bank accounts and pensions to be invested responsibly and ethically, and 80% expect their savings to have a positive impact on the world. And as a warning to laggard money managers, 74% would consider moving to another provider if they found out their current fund was investing in companies engaged in activities that were inconsistent with their values. This rises to 87% for the younger generation.

Investors under pressure to align to long-term net zero

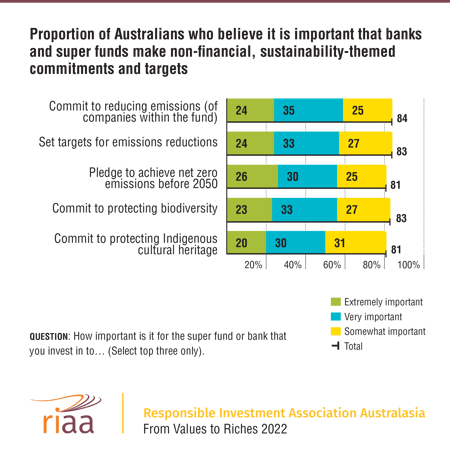

The top responsible investing issue is climate change, with five out of six Australians believing it’s important that their super fund or bank commits to reducing greenhouse gas emissions (84%), sets targets for emissions reduction (83%), and pledge to achieve net zero by 2050 (81%).

“Our research shows us that there’s really been a step change in the expectations of consumers - they do expect that pension funds and banks take strong action on climate change,” said Simon O’Connor, CEO of RIAA in a recent interview with Pathzero. “Consumers want to know that their investments are being managed in a way that aligns with the Paris Agreement and net zero by 2050 and that means they want to see changes in their portfolio, they want to see actual reductions in emissions, they want to see investors driving change in the companies to align those to long-term net zero, and to drive the transition through the companies they’re invested in.”

“Consumers want to know that their investments are being managed in a way that aligns with the Paris Agreement and net zero by 2050.Simon O'Connor, CEO, RIAA |

|

Consumers attuned to the "greenwashing" issue

In discussing the findings, O’Connor notes that consumers are becoming more astute and looking to differentiate between credible commitments and credible action on climate change. They are expecting to see action as well as integrity in the reporting on the emissions that underpin the evidence to drive that action.

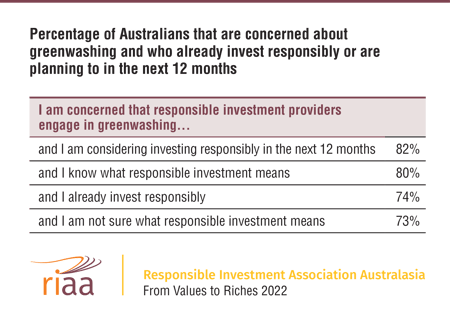

Concerns over greenwashing - the misrepresentation of a financial product as having greater social or environmental credentials than it actually possesses – remain prevalent among Australians, with 72% of the population concerned that responsible investors engage in greenwashing, particularly the younger generations (80% of Gen Z compared to 66% of Baby Boomers). This concern over greenwashing even stops 65% of Australians from switching to an ethical bank.

Consumer concerns of greenwashing aren’t unfounded, but experts point out that greenwashing can be very difficult to avoid because standardised taxonomy hasn’t been available until recently, and still isn’t in certain parts of the world. The resultant “unintentional greenwashing” has been less a failing of companies’ good intentions than an inability to navigate complex and rapidly changing terminology.

“So the question is, why is it hard for investment managers to communicate on this subject?” asks Carl Prins, Co-Founder and CEO of Pathzero, a SaaS-based company specialising in the decarbonisation of investment portfolios. “When it comes to commitments and public communication, are you talking about emissions, are you talking about gross emissions, net emissions, net zero emissions, climate neutral, carbon neutral? It’s a mine field to actually be communicating this.”

Even when investors do get the terminology right, there can be varying degrees of quality in the carbon information that’s being disclosed. In essence, it’s difficult to know – especially on a portfolio level - if public statements are based on potentially incorrect data.

“When it comes to commitments and public communication, are you talking about emissions, are you talking about gross emissions, net emissions, net zero emissions, climate neutral, carbon neutral? It’s a minefield to actually be communicating this.Carl Prins, Co-Founder & CEO, Pathzero |

|

“As a financial institution you’re looking to, firstly for yourself, understand what’s really going on in these portfolios. And then once you’ve put these plans in place, you’re trying to demonstrate to your users how that’s going. And if you don’t understand the integrity of that information or if you’re uncertain about it, well that just flows through to anyone who is then using that information downstream from there,” he adds.

Protocols less effective without robust technology

The Greenhouse Gas Protocol has set out the principles of good carbon measurement and disclosure. Simply put, this protocol states that information has to be relevant, accurate, complete, consistent and transparent.

But the protocol is just one piece of the puzzle, investors still need to do the work to ensure they adhere to these principles.

This is a significant challenge, and our current solution of using human capital with spreadsheets presents severe limitations, that could be better addressed with technology solutions. When playing to its strengths, technology can augment the work being performed by consultants, specifically, by enabling us to increase the accuracy, consistency and transparency of greenhouse gas (GHG) reporting.

-

Accuracy: For GHG emissions information to be accurate, the quantity measured for a specific company - or whole portfolio - should not be over or under the actual emissions on an ongoing basis. Technology solutions can allow for the creation and maintenance of sophisticated models that accurately estimate these emissions based on the best available data while calling out any areas of uncertainty.

-

Transparency: From a transparency perspective, the methodology and underlying data used to perform these emissions calculations should be clear and auditable. Technology allows for the creation of audit trails so that the calculation methodologies, and the information underpinning them, can be systematically recorded and easily reproduced.

-

Consistency: The methodologies used to estimate GHG emissions often vary, which can pose serious challenges for investors attempting to conduct meaningful performance tracking of changes to their financed emissions over time. Technology can help reduce this challenge by ensuring that a consistent methodology is applied, and any changes are clearly documented. This is especially critical for investors with many portfolio companies as, without the use of technology, they may not be comparing like for like.

Technology Essential to Managing at Scale, Globally

Measuring, reducing and disclosing investment portfolio carbon information at scale and in line with the Paris Agreement will present a significant challenge. Consultants alone can’t keep up with the demands of servicing all these portfolio companies, as has been the model for the last 20 years. Technology will have to play a role in helping investors accurately communicate their carbon-related claims.

“You cannot get to the scale that we need to get to as humanity, to fix climate change without technology. It just simply can’t happen. Human beings cannot keep up. Even if you bring all the consultants in the world, I don’t think we can keep up with the reporting needs for measuring carbon emissions,” said Charbel Ayoub, Co-Founder of Pathzero.

The potential rewards of solving these problems will be great for investors, asset managers and of course the world.

“You cannot get to the scale that we need to get to as humanity, to fix climate change without technology. It just simply can’t happen.Charbel Ayoub, Co-Founder & CTO, Pathzero |

|

|

|

“As much as consumers expect their investments are managed in a way that avoid the worst impacts of climate change, they actually tell us that they’re really excited to invest in those opportunities that will come from transitioning to a low carbon economy; investing in renewable energy, electrification of transport, water efficiency technologies. So there’s a lot here to be gained by the investments in the opportunities that will present themselves as we transition our economy to net zero by 2050,” adds O’Connor.

About Pathzero

Pathzero is on a mission to accelerate the decarbonisation of the global economy. By combining an unparalleled user experience, globally recognised carbon standards, and on-demand sustainability specialists, our digital platform makes carbon management and reporting more accessible, trustworthy and connected than ever before.

In addition to our core platform, we’ve developed Pathzero Portfolio, an exciting feature designed specifically for the investment community. By allowing portfolio companies to easily share their emissions profile directly with their investors through our platform, Pathzero serves as a communications network, creating a new way to bring transparency to carbon emissions information in investment portfolios. This means that for the first time, investors have the means to gain complete visibility over their financed emissions. This critical information enables them to better understand and manage their climate-related risks, seek out opportunities in the transition to a low carbon economy, and become leaders in our race to zero.

To discover how Pathzero can help you surface your financed emissions and decarbonise your portfolio, schedule a free consultation with us. To learn more about Where Carbon Meets Capital the series, click here.